DBS international money transfers Singapore – Everything you need to know

This article covers:

- How much does it cost to transfer money with DBS bank?

- DBS foreign exchange rates

- How long does a transfer take for DBS bank?

- What do I need to make an international money transfer?

- What is the process to make a transfer through DBS?

- An alternative way to send money overseas: Instarem

- Frequently asked questions

If you’ve had to send money overseas, then you probably understand what a costly and complicated hassle it can turn out to be. But it doesn’t have to be that way. Nowadays, the possibilities for sending money abroad are almost endless.

From the traditional Western Union wire transfers to services like DBS Remit international money transfer, consumers are presented with a wide range of options for money transfers between currencies from each respective country.

When sending money abroad, it’s always important to understand how the particular transfer works, including the time it takes to process the transaction, as well as the fees and rates involved.

As Singapore’s largest bank, DBS bank offers an extensive suite of services, so acquiring information on specific offerings may be challenging. To help you out, we’ll discuss all the ins and outs of DBS foreign money transfer here.

How much does it cost to transfer money with DBS bank?

There are two types of international transfers provided by DBS bank: DBS Remit and Telegraphic Transfer.

DBS remit

With DBS Remit, you to send money to Australia, Bangladesh, Canada, Eurozone, Hong Kong, India, Indonesia, Japan, South Korea, Malaysia, Mainland China, Myanmar, New Zealand, Philippines, Thailand, UK, USA, UAE and Vietnam.

There are some additional transfer fees when using DBS remit for Malaysia and Philippines.

For funds to Malaysia, however, there’ll be a 3 SGD service charge for amounts less than 500 SGD. Although you are presented with an attractive fee structure, you are however subjected to a higher FX rate.

To transfer to Philippines, there’ll be 1 SGD fee incurred via GCash wallet for amounts 150 SGD and below. And recipients aged 16 years and below are not allowed to claim the remittance amount.

DBS telegraphic transfer to countries not covered by DBS remit

For countries not covered by DBS Remit, internet banking or a branch visit will be the next best option to perform an international transfer, Outward Telegraphic Transfer (OTT), where you will be looking at the fees structure as below:

| Outgoing telegraphic transfer (OTT), online set-up | Outgoing telegraphic transfer (OTT), branch set-up |

Cable/telex charges | 20 SGD | 20 SGD |

Handling commission for transfers up to 5,000 SGD | 5 SGD | 1/8% of the transfer amount (min 10 SGD, max 120 SGD) |

Handling commission for transfers up to 25,000 SGD | 10 SGD | |

Handling commission for transfers above 25,000 SGD | 35 SGD |

Other bank charges and fees to take note of include:

Utilizing services of a bank agent | Additional fees may apply | |

Fees by Sending/ Recipient bank | On top of the charges from DBS, further

The SWIFT system processes the majority of international transfers and frequently involves multiple banks, each of which may impose its own cost as your money moves through the system.

The more banks are involved in the process, the higher your final cost will be. You will only find out once the transaction is done. | |

Additional charges |

| |

DBS foreign exchange rates

Now when you send money overseas, foreign exchange rates come into play.

Banks in Singapore such as DBS bank add a significant margin to the interbank foreign exchange rate which could increase your final cost significantly. You may think of this as a slight devaluation of your currency in comparison to what you would see in mid-market exchange rates (the exchange rate you see on Google), with the bank profiting from that disparity.

So even if you don’t pay any fees, the markup on the exchange rate can cause transfer costs to skyrocket, and you end up paying more overall. Unspecified cost due to the deviation from mid-market rate makes the service less favourable than the rates offered by other specialised money transfer providers that provide transparent pricing structure before you perform any transfer.

How long does a transfer take for DBS bank?

For same day transfers and cut off time choose DBS remit

With DBS Remit, if the payment is made on a weekday before the cutoff time, DBS remit offers same day transfer. Transfer cutoff timings differ by country, with some being earlier than others. It is important to take note if you want to send money urgently.

Here are some of the cut-off timings:

Destination country | In specific currencies | Cut-off Time for Same-Day Transfer (SGT) | Same-Day Transfer Available Between# | Daily Transfer Limit* |

Australia (in AUD) | AUD | 12:00 PM | Mon to Sat | SGD 200,000 |

Bangladesh Account Transfer & Cash Pickup | BDT | 11:00 AM | Mon to Thurs | SGD 200,000 |

Bangladesh bKash Wallet | BDT |

| Mon to Sat | SGD 200,000 |

Canada | CAD | 5:00 PM | Mon – Fri | SGD 200,000 |

Eurozone | EUR | 5:00 PM | Mon to Sat | SGD 200,000 |

Hong Kong | HKD | 4:30 PM | Mon to Sat | SGD 200,000 |

India | INR | 4:30 PM | Mon to Sat | SGD 200,000 |

Indonesia | IDR | 2:00 PM | Mon to Sat | SGD 200,000 |

Japan | JPY | 10:30 AM | Mon to Sat | SGD 200,000 |

South Korea | KRW | 2:00 PM | Mon to Sat | USD 20,000 |

China | CNY | 3:00 PM | Mon – Fri | SGD 200,000 |

Alipay Wallet in Mainland China | CNY | – | Mon – Fri | SGD 200,000 |

Malaysia | MYR | 2:00 PM | Mon – Fri | SGD 200,000 |

Myanmar | MMK | 12:00 PM | Mon – Fri | SGD 200,000 |

New Zealand | NZD | 10:00 AM | Mon to Sat | SGD 200,000 |

Philippines | PHP | 11:00 AM | Mon to Sat | SGD 200,000 |

GCash Wallet in the Philippines | PHP | – | Mon to Sat | SGD 200,000 |

Thailand | THB | 3:30 PM | Mon – Sun | SGD 200,000 |

United Arab Emirates | AED | 5:00 PM | Mon to Sat | SGD 200,000 |

United Kingdom | GBP | 5:00 PM | Mon to Sat | SGD 200,000 |

United States | USD | 5:00 PM | Mon to Sat | SGD 200,000 |

Vietnam (in VND) | VND | 2:30 PM | Mon to Sat | SGD 200,000 |

Outward telegraphic transfer

Outgoing Telegraphic Transfer (OTT) will require around 2 to 4 working days for the transaction to be finalised.

What do I need to make an international money transfer?

There are several important details that you will need to send an international money transfer such as the recipient’s full name, address, bank information (SWIFT/BSB/sort/IFSC codes, if applicable) and account number (IBAN).

Next, provide the currency and amount you wish to transfer, along with any bank costs levied by the agent, and whether such charges will be imposed on you as the sender or your recipient.

For transactions in certain currencies, additional information may be required such as a legitimate purpose for transfer and a registered phone number.

What is the process to make a transfer through DBS?

Whether you are sending money with DBS remit or DBS outward telegraphic transfer, you will need a online internet banking account.

There are two ways to open an account: via digibank or online application.

If you are an existing DBS account holder, you can skip the registration process and simply log in to mobile banking or DBS Internet to access your overseas fund transfer options.

Once your account is all set up and you’ve received your security token, follow these steps to initiate a transfer:

Access your DBS Digibank account by logging in

Select “Transfer” to open a drop-down menu and choose “DBS Remit and Overseas Transfer”

Specify a country and a currency for the transfer.

Input the amount you wish to transfer

Check the exchange rate and the transfer fees

Add your recipient

Confirm your transfer

To use the FX watch function, check the box for “FX Watch”, enter the FX rate you wish to use, and specify when you need the funds. If you wish to use this feature, note that there is a minimum of 1,000 SGD.

An alternative way to send money overseas: Instarem

Sending money overseas has a bit of a reputation for being pricey, especially if you’re making regular overseas funds transfer to and from your bank account.

Most of the time, these transfers go through the SWIFT network, which means intermediary banks get involved and take a cut along the way. On top of that, banks often add a markup to the exchange rate, so you end up paying more than you expect.

The good news? You’re not limited to traditional bank transfers. Beyond DBS, there are online remittance services like Instarem that offer better exchange rates, same-day transfers, and even a discount or promo code for first-timer.

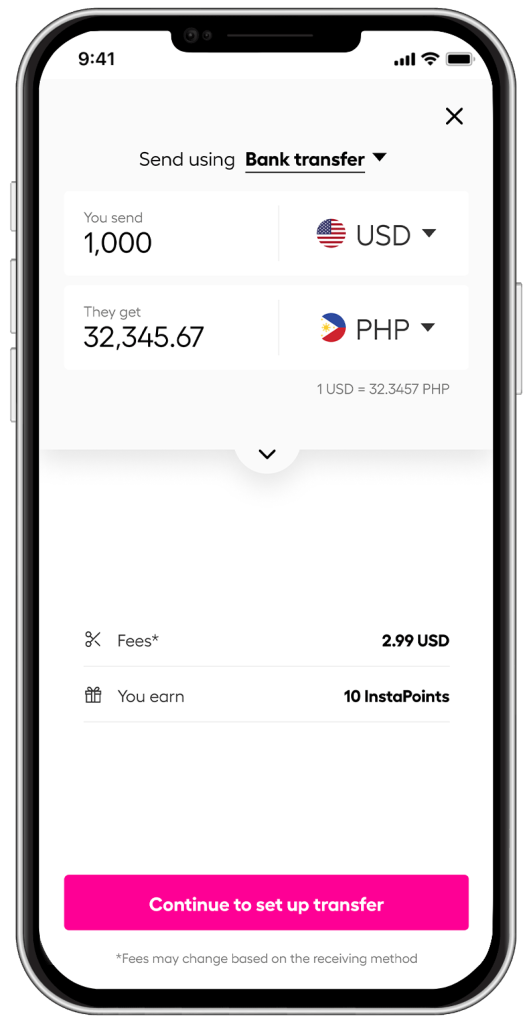

*Rates are for display purposes

Instarem allows you to send money online or straight from the app, whenever it’s convenient.

And with just a small transfer fee, you get exchange rates that are close to the mid-market rate so no nasty surprises.

Download the app or sign up on the web and see how easy it is to send money with Instarem.

Frequently asked questions

How long will DBS remit take to transfer funds to overseas account?

For same day transfers, use DBS Remit and ensure your overseas transfer is made before the country-specific cutoff.

Do you need a DBS account to make bank transfer to other bank account?

Yes, you need to have an account with DBS before your transfer funds.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.