Recurring transfers: Instarem’s simple solution for smart money transfers

This article covers:

If you’re in Singapore, we’ve got some fantastic news for you! Instarem has introduced a new feature that allows you to schedule your money transfers in advance. With this feature, you can now plan and repeat transfers according to your needs, ensuring your financial transactions are smooth and hassle-free.

Take control of your payments

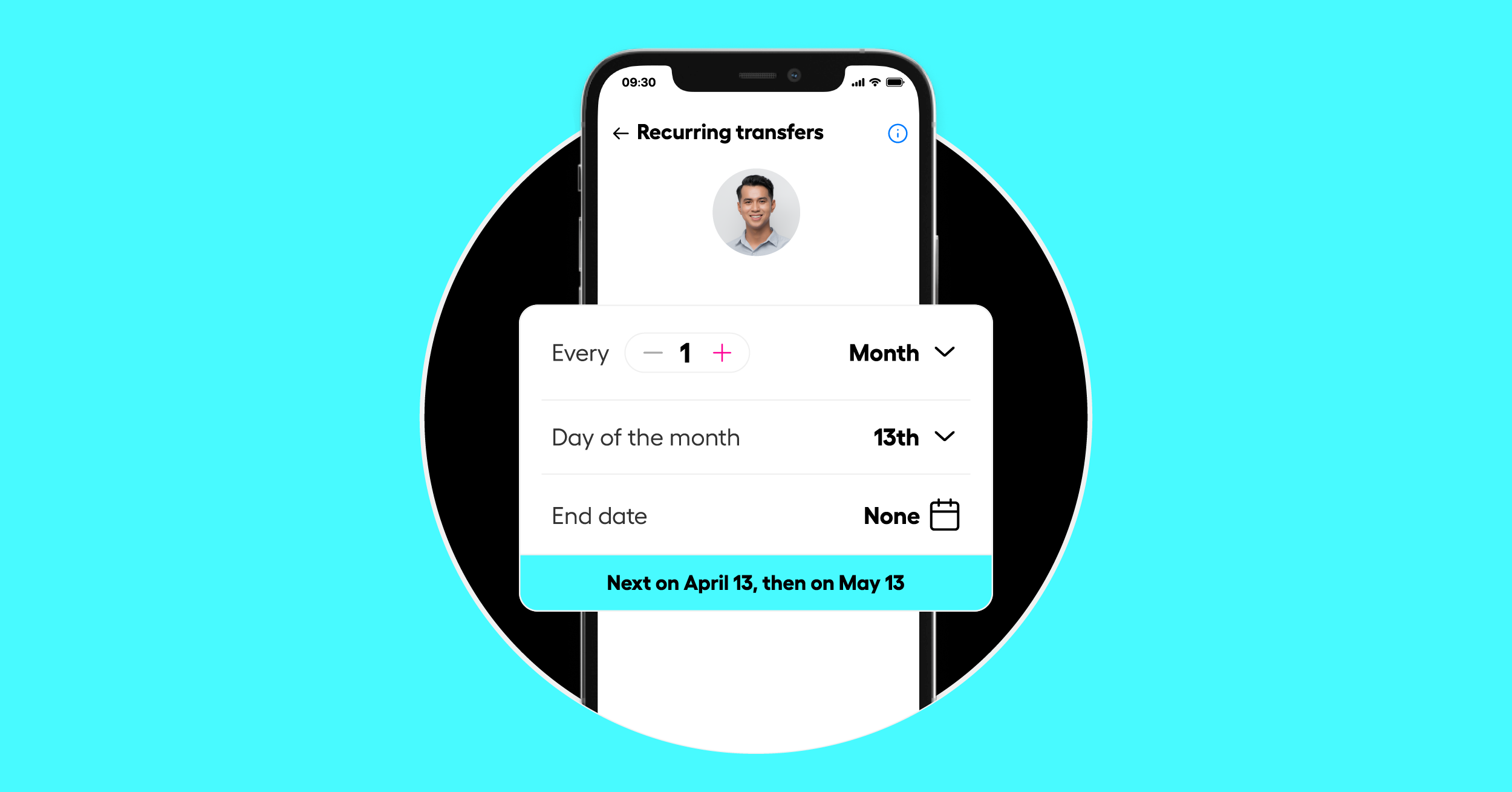

Whether you prefer weekly or monthly payments, the choice is entirely up to you. Instarem’s scheduling feature lets you tailor your payment schedule to your convenience and financial strategy. This means you can consistently support your loved ones or make timely loan repayments with ease.

Flexibility at your fingertips

Life can be unpredictable, and your financial needs may change. Instarem understands this, and that’s why we give you the ability to modify, pause, or cancel your payment schedule at any point. This flexibility puts you in control, allowing you to adapt to changes in your financial situation without any hassle.

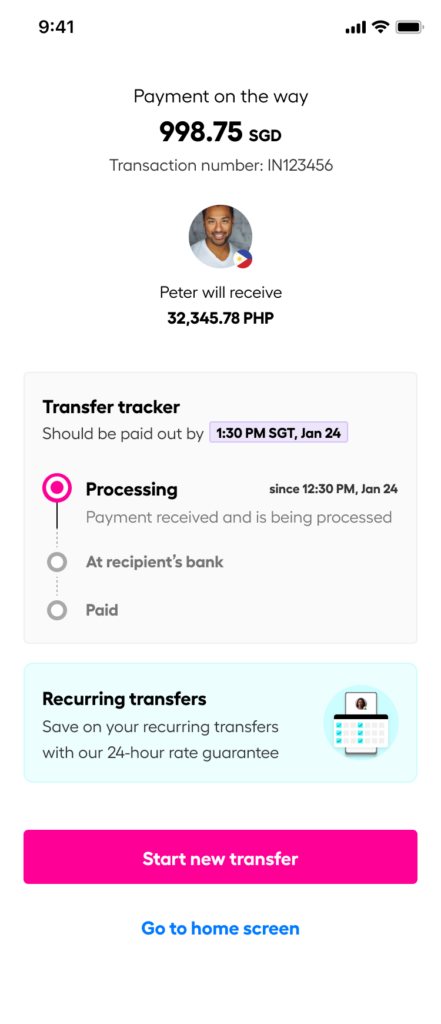

Get the best rates, hassle-free

Currency rates can be volatile, but you don’t need to worry about tracking them. Instarem ensures that you get the best rates available within 24 hours before your transfer is made. This way, you can be certain you’re getting the most value out of your transfer. We’ll also keep you informed about how much you save on each transaction, making the process transparent and helping you make informed financial decisions.

Easy scheduling options

You have two convenient ways to schedule your money transfers: directly from your transaction history or right after your initial transaction. And here’s a handy tip – you can fast track your scheduled transfer by linking your bank account to your Instarem account.

Unlocking financial benefits: Real-life scenarios

Now, let’s explore some real-life situations where scheduled transfers can have a significant impact on your financial well-being.

Supporting family

Scheduled payments make it easy to provide steady financial assistance to your family. This method helps manage crucial expenses, saves time, and may even reduce transfer fees. With Instarem, you can have peace of mind knowing your family’s needs are met, no matter where they are.

Loan repayments (Education, housing)

Scheduled loan repayments ensure you never miss a due date, maintaining an excellent credit rating and avoiding late fees. This strategy speeds up your journey to becoming debt-free, eliminating additional costs beyond your loan amount.

Studying abroad

Timely payment of tuition fees is crucial to avoid extra charges and reduce financial stress. By scheduling payments for overseas education, you can take advantage of favourable exchange rates, potentially saving money in the process.

Savings & investments

Setting up scheduled payments is a smart way to build savings or make investments. It guarantees regular contributions, encourages financial discipline, and promotes automatic growth. This approach brings you closer to your financial goals, enhances security, and allows your funds to earn interest, securing a prosperous financial future.

Ready to send money?

Sign in now to start scheduling payments for effortless transactions.

If you don’t have an account yet, you can easily download the app or sign up on our website. Instarem is here to make your financial life simpler and more convenient. Try it out today!

![Wise vs Revolut: Which to choose? [2026 Review]](https://qa.instarem.com/wp-content/uploads/2024/03/1572_blog-feature-image-04-768x403.jpg)