4 biggest accounting challenges faced by global companies

This article covers:

While conducting business from multiple locations may be a sign of achievement, managing a multi-locational business has its own challenges.

The phenomenon translates into significant stress on manpower, financial resources, and time management to ensure a smooth functioning business.

It takes an extraordinary effort to align stakeholders – divided by nationalities, languages, and work cultures – towards the common goal of an organisation’s success.

Maintaining books of accounts of multiple entities spread across different locations, and consolidating them for a cohesive presentation is not always easy, given the different currencies, they deal with as well as conflicting accounting standards, different practices, rules and regulations.

Accounting standards cover topics such as how to account for inventories, depreciation, research & development costs, income taxes, investments, intangible assets, and employee benefits – all of which are computed differently in different jurisdictions.

Here are some of the major accounting-related challenges faced by multinational corporations globally, and how they are tackling them:

1. Different local regulations for every country

Generally Accepted Accounting Principles (GAAP) vary from one country to another. For instance, IFRS, SFRS, US GAAP and Ind AS; there is no single universally-accepted reporting standard.

Regulations related to accounting, legal matters, and taxation vary for almost all countries in the world, which impacts accounting and even the profitability of a company operating in different geographies.

With emerging new complex business realities, there are frequent changes in these regulations that must be incorporated to stay on the right side of the law.

It is extremely important to keep track of the changes in regulations to ensure that the financial statements of a corporation that’s spread out in different geographies are in proper order.

2. Consolidation of entities in a group

Accounts of each individual entity need to be maintained as per the rules and accounting standards of the country of operations.

However, given the continuous fluctuations in different currency rates, it is important to ensure that appropriate foreign exchange rates are applied for evaluations and for converting the respective local currency amounts into the reporting currency.

As this affects all aspects of an entity such as:

- Revenue,

- Expenses,

- Fixed Assets,

- Current Assets and Liabilities,

- Share Capital, Loans

- and more

The exercise itself comes with its own set of challenges and is quite time-consuming.

3. Calculation of impairment of investment in subsidiaries

Making investments in overseas subsidiaries is a normal affair at multinational corporations.

It is important to keep track of the impairment of investments in subsidiaries, especially in the entities which are making losses and/or are in inaccessible locations or countries with a difficult political scenario; until the subsidiary is capable to recover the investment made by the holding company.

4. Transfer pricing and intercompany cost allocations

Transfer Pricing (TP) is fixing the price of goods and services sold between the related entities, within a group of entities.

For instance, if a subsidiary sells goods or services to the parent company, the consideration for those goods/services paid by the parent to the subsidiary is the TP.

TP results in the setting of prices among divisions within an enterprise and can be used as a profit allocation method to attribute a multinational corporation’s net profit (or loss) before calculating tax to countries where it does business.

Thus, appropriate accounting from the perspective of TP and intercompany cost allocations is highly desirable for multinational corporations that are involved in regular financial transactions with global subsidiaries.

There are various laws and rules related to TP, and ensuring compliance in different jurisdictions that the Group operates in is becoming increasingly challenging and costly, as business and regulations evolve continuously.

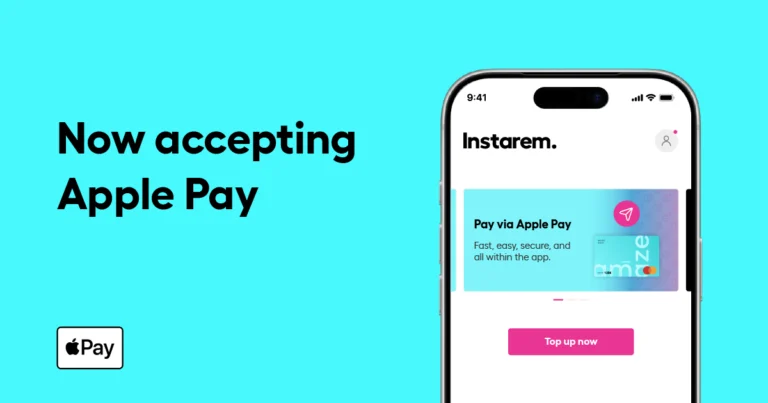

With so much to handle, accounting firms stretch themselves thin as they also manage payments for these MNCs. Digital payments platforms like Instarem can really help ease the burden.

With features like multi-currency payments & accounts, competitive fee, transparency, and speed; Instarem provides you with an online platform to process payments anytime anywhere at a fraction of the cost you currently bear.

![Wise vs Revolut: Which to choose? [2026 Review]](https://qa.instarem.com/wp-content/uploads/2024/03/1572_blog-feature-image-04-768x403.jpg)