How Employers Can Transfer Salaries to FDW Families in Indonesia

This article covers:

- Key takeaways

- Understand the risks and requirements

- Choosing the right transfer method

- How to compare transfer options quickly

- Essential safety and preparation steps

- What’s the best option to transfer salary to FDW families in Indonesia?

- Final thoughts

- FAQs on how to transfer salary to FDW families in Indonesia

Key takeaways

- This blog helps employers send salaries to FDW families in Indonesia safely and efficiently. It explains the risks, compares transfer methods and shows how to protect every dollar.

- Choose the right transfer method: Compare banks, cash pickups and modern money transfer operators. Services like Instarem offer fast, low-cost and transparent transfers.

- Keep fees and rates low: Even small costs cut into your helper’s family’s income. Check upfront fees and exchange rates to maximise the money sent.

- Verify recipient details: Double-check account numbers, bank codes, or ID info. One wrong digit can delay or block the transfer.

- Prioritise safety and speed: Use licensed platforms for international money transfers. They protect funds from fraud and deliver payments quickly, often the same or the next day.

Payday should bring peace of mind, not stress. When a salary goes to a helper’s family in Indonesia, each dollar supports food, school fees and daily needs. In Singapore, many Foreign domestic workers (FDW) earn about S$550–S$800 per month, so every part of that pay matters.

However, even small transfer costs can reduce what families receive. The World Bank reports that global remittance fees average 6.49% of the amount sent, which can add up fast. Slow transfers and unclear fees create risk. That’s why a safe, low-cost method helps protect both the worker and the employer.

Advanced payment options like Instarem offer a more direct way to send funds without long bank delays. This guide explains how to choose the right method, lower risk and make sure the salary reaches home safely.

Let’s walk through the steps that keep money transfers to Indonesia smooth and secure.

Understand the risks and requirements

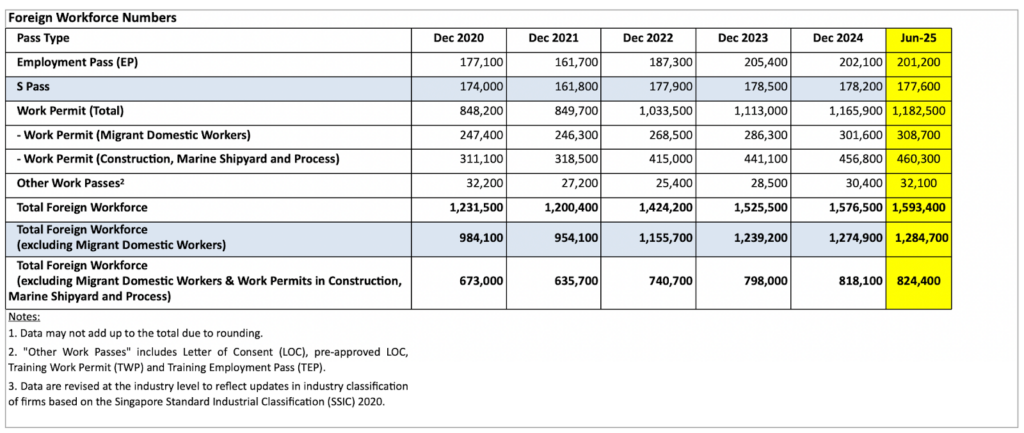

As of mid-2025, there are over 308,700 migrant domestic workers in Singapore. A large portion of these workers come from Indonesia, making safe salary transfers a vital monthly task for thousands of households. Before you pick a way to send salary, you need to know what can go wrong and what you must watch for.

Image source: Ministry of Manpower

International money transfers come with real risks that can affect what the family gets. If you miss these, the family may get less than you expect, or the money may arrive late or not at all. That’s why it helps to know the key points below before you send a cent.

- Security

Check safety first. Scammers often use fake links and messages to steal login details. Weak systems make fraud easier. For example, a scammer may pretend to be a bank and ask for a code.

If you share it, they can take the funds fast. Strong security steps like two-step login authentication, secure apps and official site access help stop this risk before money leaves your account.

- Fees and exchange rates

Costs for international money transfers can vary a lot. A report from The Jakarta Post shows that many workers in Singapore send about S$117 home each month. If you pay a S$5 fee, that is over 4% of the total sent.

High fees reduce money for food and school. World Bank data also shows that total costs can differ widely between providers. A fair rate helps the family receive more of the pay earned.

- Speed

Fast transfers matter in urgent times. A sick child or a late bill cannot wait. Some banks take days to move funds. Delays cause stress and fear. Quick service gives the family help right when they need it.

- Accessibility

Families live across Indonesia, often in small towns. Some areas lack large banks or city branches. If pickup points sit far away, travel costs rise. Long trips also take time from work or home duties. Choose a method that’s easy for the family to access.

- Identity verification

Always double-check the recipient’s details before sending money. Confirm the full name, account number and bank or service information. One wrong digit can send funds to the wrong person.

Also, check if the recipient needs a bank account or if an ID alone works. If her family lacks the right paperwork, the money could get stuck. Learn the rules in the local area before you hit send. Taking these steps ensures the funds reach the right person safely and on time.

Choosing the right transfer method

Choosing how to send salary is important. International money transfers come with fees, delays and rules that can affect how much the family actually receives. Some methods take days and charge high fees, while others move money faster and cost less. Knowing the options helps you avoid mistakes and make sure every dollar counts.

Ease of use also matters. Some methods need a bank account, while others only require an ID. Checking these details keeps the transfer smooth and stress-free. Next, we break down the main choices—modern money transfer operators, traditional banks and cash pickup services—and what each offers.

Dedicated money transfer operators (MTOs)

Dedicated money transfer operators (MTOs) are services built to move money across borders quickly and safely. They focus on international money transfers, which allows them to offer better rates and lower fees than most traditional banks. These platforms use secure digital systems to send money straight to the recipient’s bank account, cutting down delays and hidden costs.

Instarem is a prime example. It provides fast, reliable transfers from SGD to IDR, with transparent fees and clear exchange rates. With Instarem, you can see exactly how much the family will receive, which makes budgeting easy. Their platform is regulated and licensed, adding a layer of safety for both sender and recipient.

| Pros of using MTOs | Cons of using MTOs |

| Most transfers land on the same day or the next.All fees are shown upfront, so there are no hidden costs.You can track your money from your phone at any time.Data from the World Bank shows digital firms have lower total costs than traditional banks. | Both sender and recipient must provide valid ID and account information.Require internet access to complete transfers.There are set limits on how much you can send in one go. |

Traditional bank transfers (Telegraphic transfers)

A traditional bank transfer is the most common way to send money. People often call it a ‘wire’ or a telegraphic transfer (TT). The bank moves funds from your account in Singapore to a bank account in Indonesia. You can do this at a branch or through your bank’s app. For example, with major banks like DBS or UOB, you fill out a form with the recipient’s account details.

Banks keep your money very safe, but they’re not always ideal for small, monthly payments. When you compare real-time rates, banks often deliver less value because of high fixed fees and lower exchange rates compared to digital-first options. This reduces the amount that reaches her family. Transfers can also take 2–5 working days to arrive, which may delay urgent payments.

| Pros of using bank transfers | Cons of using bank transfers |

| Banks use top-tier security to guard your funds.Most employers already have a bank account and know the process.It’s a good choice for sending very large, one-time sums of money.You get a clear paper trail that is easy to track. | Often the most expensive option due to high fixed fees and poor exchange rates.Transfers can be slow, taking 2–5 business days.Hidden ‘agent fees’ from other banks may be taken out of the total. |

Cash pickup services

Cash pickup services let the recipient collect money in cash at a local agent or branch. They work well for families who don’t have a bank account. You send the funds through a provider like Western Union or MoneyGram, and the family goes to a nearby agent with a valid ID to pick up the cash.

These services are fast—sometimes the money is ready within minutes. They also give flexibility for families who live far from a bank or prefer cash. For example, if the helper’s family lives in a smaller town in Indonesia, they can receive funds at a local agent instead of opening a bank account. The service shows the exact amount to be picked up, which makes planning easier.

| Pros of using cash pickup services | Cons of using cash pickup services |

| The family can get the cash in just a few minutes.No bank account is needed for the person in Indonesia.There are many pickup spots in small towns and villages. | Fees can be high compared to digital tools like Instarem.The exchange rates are often poor, so less money goes home.It can be risky for the family to carry a lot of cash on the street. |

How to compare transfer options quickly

Choosing the right way to send money can be tricky. Each method has its own speed, fees and ease of use. Understanding these differences helps you make sure the family gets the full pay on time. This balanced comparison shows the key points so you can pick what works best for your helpers and their families.

Here’s a snapshot of the main methods:

| Method | Speed | Exchange rate | Transfer fees | Recipient requirement | Best for |

| Money transfer operator (e.g., Instarem) | Fast (Same/next day) | Very competitive rates, often better than banks | Low and fully transparent; you see exactly what the family will receive | Bank account needed | Regular transfers, smaller amounts, cost-effective, predictable |

| Traditional bank transfer | Slow (2–5 days) | Poor rates; banks often offer lower rates than digital services | High fixed fees plus hidden costs, which reduce the amount the family gets | Bank account needed | Large, infrequent payments where security and official records matter |

| Cash pickup service | Very fast (Minutes to hours) | Moderate rates; may be worse than digital operators | Fees vary by location; can be high if sending small amounts | Valid ID required; bank account not needed | Families who need fast cash or don’t have a bank account; urgent situations |

This table shows the trade-offs between speed, fees and convenience. Digital operators like Instarem offer quick transfers at a lower cost, while banks provide security for large sums. Cash pickups work well when families need fast cash or lack a bank account. Choosing the right method ensures each payment reaches the family safely, saving time and stress.

Essential safety and preparation steps

Sending money abroad requires care. Even small mistakes can delay funds, reduce the amount received, or cause stress for your helper. Knowing the right steps ensures your transfer is fast, secure and reaches the family as intended. Without proper preparation, errors in account details, missing ID, or weak security can create big problems that could have been avoided.

Taking a few key precautions makes each transfer smooth and predictable. These steps cover verification, communication and the right platforms. Let’s walk through them next so you can send funds with confidence and peace of mind.

Ensure you complete account verification

Verification means checking that all details are correct before sending money. This includes the recipient’s name, bank name, account number and any codes like SWIFT or BIC for bank transfers. Verification also ensures your transfer complies with local and international standards, reducing the risk of errors or legal issues.

If you skip verification, the money can get stuck for days or even be lost, causing stress for both your helper and her family. It also increases the risk of fraud if details are shared carelessly.

Here’s how to verify for each method:

- MTOs (like Instarem): Confirm your identity and the recipient’s bank details on the platform. Double-check names, account numbers and bank codes. Some platforms may request extra documents, like a selfie and a valid ID, to secure the transfer.

- Bank transfers: Verify the recipient’s full account number, bank name, branch and SWIFT/BIC code. Review all details carefully before submitting to avoid mistakes.

- Cash pickup services: Check the recipient’s legal name exactly as it appears on their ID. Ensure they know the collection code and the agent’s location.

Communicate clearly with the FDW

Clear communication with your helper is key to smooth salary transfers. It ensures they know when the money is sent, how much arrives and that their family can access it without issues.

Poor communication can create confusion, delay, or even stress if the family doesn’t receive the funds on time. Setting clear expectations builds trust and keeps the transfer process predictable for everyone involved.

Here are practical steps to follow:

- Set a schedule: Agree on a fixed monthly transfer date. For example, you might send the money on the 25th of every month so your helper and their family can plan bills and expenses. This avoids uncertainty and keeps everyone on the same page.

- Confirm receipt: Once you initiate the transfer, notify your helper immediately. Ask them to confirm with their family when the funds arrive. This step ensures that any delays or errors are caught quickly, preventing unnecessary stress.

- Provide documentation: Keep copies of all transfer receipts and share them with your helper. This provides proof of payment, helps track transfers and makes it easier to resolve issues if they arise.

Use secure platforms

Using a secure platform is essential when sending money abroad. Safe services protect your funds from fraud, errors and delays. Without proper security, even small mistakes can cause transfers to fail or money to go missing. A trusted platform keeps both you and the recipient protected at every step.

For instance, platforms like Instarem follow strict rules to ensure safety. Instarem is licensed and regulated in 11 countries, including by the Monetary Authority of Singapore. This means every transfer follows clear legal standards, and your funds are handled with care.

Secure platforms also make sending salary simpler. You can check fees, track payments in real time and confirm the exact amount your helper’s family will receive. This reduces stress and ensures each transfer goes smoothly. By choosing a verified service, you not only protect your money but also strengthen trust with your helper.

What’s the best option to transfer salary to FDW families in Indonesia?

Finding the best way to make an international money transfer is different for every home. It depends on what works for both you and your helper. You may prioritise low fees, while they need the money to reach a bank far away. Factors like their family’s location and how quickly they need the funds also matter. Choosing a method that’s simple for you and useful for them is essential.

Banks are safe but often slow and costly. Cash pickup services move money quickly but may charge high fees and offer poor rates. While these methods work, they may not be ideal for regular monthly pay. Instarem provides a modern option that combines strong security with competitive costs, giving fast, reliable transfers without sacrificing value.

Still, it’s crucial to check all options and discuss them with your helper. Confirm which methods your helper’s family can access easily and review fees and exchange rates together to avoid surprises. A short conversation can prevent delays and ensure everyone feels confident in the transfer.

The best choice is a service that provides a clear receipt and maximises the amount arriving at home. Using a provider that’s transparent about costs shows respect for your helper’s work and helps build trust. This ensures their salary reaches their family safely, on time and in full, supporting a stable life for them in Indonesia.

Final thoughts

Sending a salary to Indonesia is more than a monthly task. It shows your helper that you value their hard work and care for their family. By choosing a safe path, you make sure their family receives every cent they need for food, school and health. A smart choice today strengthens your bond and gives your helper peace of mind while they work in your home.

Digital transfers have made sending money faster and cheaper. The global goal is to cut remittance costs to under 3% by 2030. By picking the right provider, you help achieve that for your helper.

If you want a fast, safe and fair method, Instarem makes international money transfers simple. Our platform is clear, with great rates and no hidden fees. Thousands of households in Singapore use Instarem to stay connected to loved ones in Indonesia.

Register an account on our app and send your first payment in minutes. Smart transfers today set the standard for reliable, stress-free payments every month, making each salary count.

FAQs on how to transfer salary to FDW families in Indonesia

What is the safest way to send a salary to FDW families in Indonesia?

Using a licensed platform like Instarem ensures your money reaches the right family safely. The platform follows strict rules, offers clear fees and tracks every transfer in real time. This reduces delays, fraud and mistakes.

How fast can money reach an FDW family in Indonesia?

Transfers through modern platforms like Instarem usually arrive the same day or the next day. Cash pickups are also fast, often within minutes. Traditional bank transfers can take 2–5 business days.

Do I need a bank account to send money?

Not always. Money transfer operators require a bank account for the recipient. Cash pickup services only need a valid ID. Banks need both you and the recipient to have accounts.

How much will my helper’s family receive?

The amount depends on fees and exchange rates. Platforms like Instarem show the full amount upfront, so you know exactly how much the family will get. This helps reduce hidden costs and maximise funds sent.

Why should I choose Instarem for international money transfers?

Instarem combines speed, security and fair rates. It’s licensed in 11 countries and tracks each transfer. This makes sending salary predictable, stress-free and cost-effective for both you and your helper’s family.