How to score a free business class seat without breaking the bank?

This article covers:

- 1) Pick the right card for your lifestyle!

- 2) Maximise bonus categories

- 3) Pay the annual fees and grab those sign-up bonuses

- 4) Gotta have a stack of cards

- 5) Hitting life’s big moments? Perfect time to rack up those miles!

- 6) Join airline alliances

- 7) Sign up for frequent flyer programmes

- 8) Accelerate apps

- 9) Redeem miles strategically

- 10) Book during promotions

- Other things to note…

- The reality: You need a strategy

- Before you go…

Ever dream of flying in luxury, lounging in business class like a Crazy Rich Asian without a care in the world? The harsh reality: a business class ticket can cost 3 to 5 times more than economy. And let’s be honest, in a world where you have to choose between bread or love, you’re probably going to pick bread (aka saving that cash).

But hey, who needs a cushy flight anyway, right? You’re just going to sleep for a few hours. Still, if you play your cards right (literally), you can snag a business class seat without paying a dime.

In this blog, we’ll break down the basics of redeeming business class flights for free.

1) Pick the right card for your lifestyle!

Not all credit cards are created equal, my friend! Some dish out cashback or reward points, but we’re here for the ones that help you rack up those air miles—because who doesn’t want to fly in style?

Rewards cards let you earn miles based on spending, and air miles cards are even simpler: you’ll often hear “miles per dollar”. This basically means how many miles you snag per dollar you spend. Most cards offer around 2.5 miles per dollar, but some let you score up to 4 miles per dollar.

Pro tip: If you’re spending overseas, most miles cards give you more bang for your buck. Just keep an eye on your card’s bonus categories—that’s where the real magic happens!

2) Maximise bonus categories

Dining, petrol, groceries, travel—these are potentially goldmine bonus categories that can boost your air miles haul!

Some people say you should load up on air miles cards, but why complicate things? It’s all about picking a card that suits your lifestyle. No need to stress over bonus categories you don’t even use.

Make your credit card work for you, not the other way around! Some cards even partner directly with airlines, making point transfers a breeze. And if you’re unsure about bonus categories, check the merchant code—because buying food at Donki might count as “supermarket”, and if you’re not using the right card, you could miss out on points.

3) Pay the annual fees and grab those sign-up bonuses

Skipping annual fees is everyone’s go-to move, right? But with air miles credit cards, paying those fees can actually score you more miles. So, go ahead and pay up!

Also, if you’re new to a credit card, banks love to reward you with a chunky sign-up bonus. Just remember, there’s usually a catch—you’ll need to hit a spending target within a few months. But hey, if you’re about to get married or buy a house, that spending can pay off big time!

4) Gotta have a stack of cards

When it comes to miles cards, each one has its quirks. For cards that offer over 1.2 miles per dollar, there’s usually a catch—either a cap on eligible spending categories or a maximum amount that qualifies. Once you hit the limit, the extra miles aren’t convertible, and anything stuck at 1.2 miles per dollar is basically a slow crawl to that dream seat. Farming miles this way is great… if you’re not in a hurry!

To make the most of it, match your main spending categories with a few different miles cards. This way, you can fast-track your way to free flights without going over budget. Plus, there are budgeting tools to keep your spending on track, so no worries there!

5) Hitting life’s big moments? Perfect time to rack up those miles!

Let’s face it—without major expenses (like, say, a wedding or a home purchase), earning miles can feel like watching paint dry. But if you’re about to buy a house, plan a wedding, head off on a big trip, or welcome a new family member, these milestones often come with a hefty price tag. Why not make the most of that spending by stacking up miles along the way?

Worried about those pesky spending caps some cards have on mile-earning? No sweat! For example, if your card caps miles on purchases above $1,500, just ask the vendor to split the payment into installments. Not only will this keep you racking up miles, but it might give your bank account a little breathing room, too.

Of course, while this is a popular strategy, remember that piling on too much debt is never a great idea! So, spend wisely and fly high on those miles.

6) Join airline alliances

Joining a frequent flyer program opens the door to partner airlines within alliances like Star Alliance, SkyTeam, or Oneworld. That means you’re not tied to just one airline when it comes to redeeming miles.

Just keep in mind that different programmes have different mile requirements, so shop around before booking!

7) Sign up for frequent flyer programmes

Get in on those frequent flyer programmes with airlines you love—think American Airlines AAdvantage, KrisFlyer, and more. They often partner with credit cards, hotels, car rentals, and even restaurants to give you extra chances to earn miles. More partners, more miles, more flights!

8) Accelerate apps

Here’s a hack: the Kris+ app under KrisFlyer gives you up to 9 miles per dollar at partnered stores and restaurants. Add that on top of your regular miles card earnings, and you’re sitting pretty. Spend $400 at a partnered restaurant 10 times, and bam—you’re practically earning a business class flight from Singapore to Japan!

9) Redeem miles strategically

Strategic is the name of the game. Use award calculators to figure out the best routes and dates for redeeming business class seats. Be flexible—changing up your travel dates can unlock some seriously sweet deals.

One more thing: avoid waitlisting for flights if you can. It’s like playing the lottery—there’s no guarantee you’ll get a seat, and you might not find out until two weeks before your flight. If you’re the “YOLO” type, go for it! But if you’re a planner who hates surprises, this might not be your vibe.

10) Book during promotions

Airlines often run promotions where you need fewer miles for business class tickets. Stay in the loop by signing up for newsletters and keeping an eye on special deals. The KrisFlyer Global Redemption Sale, for example, gives you 25% off Saver award tickets for certain routes. Fastest fingers win, so act quick!

Other things to note…

Redeeming miles for a Southeast Asian business class flight? Not so fast! Not all business class flights are created equal.

Regional flights usually run smaller planes, meaning you won’t get those plush, lie-flat seats. Instead, you might just get a bit more legroom. Before redeeming your miles, check what type of airplane model you’ll be flying on. Singapore Airlines even shows you the type of business class seat based on the plane model on their website.

The reality: You need a strategy

Scoring a business class seat with points? Amazing! But let’s be real—it’s not as easy as it sounds. If you’re just getting started, keep it simple: use a few well-chosen cards and see if the miles game is for you.

Track your progress to check if you’re:

- Earning miles fast enough to book the flights you actually want,

- Doing it within a timeline that works for you.

Without big-ticket expenses (like weddings or home purchases), it can take a while. You’ll likely need a few credit cards, some patience, and a touch of flexibility.

But hey, those plush, lie-flat seats are so worth the hustle!

Before you go…

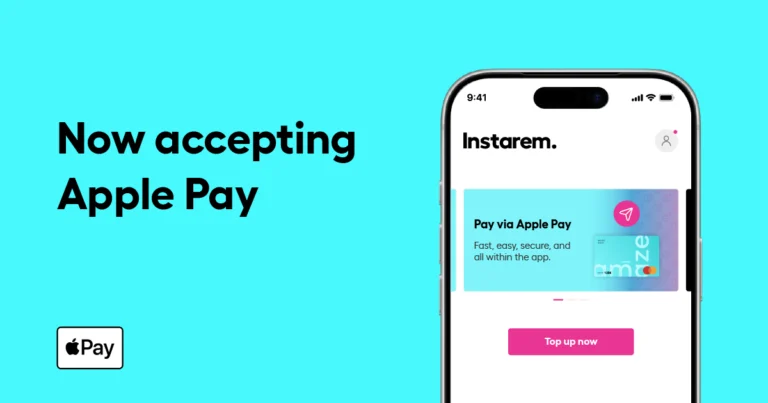

If you want to earn even more miles, link your credit card with the amaze card from Instarem! You’ll save big with great FX rates and score rewards on all your overseas spending. Best part? Signing up through the Instarem app is completely free—and instant!

*Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

![Wise vs Revolut: Which to choose? [2026 Review]](https://qa.instarem.com/wp-content/uploads/2024/03/1572_blog-feature-image-04-768x403.jpg)