Steps to track your international money transfer

This article covers:

- Overview of international money transfer

- Interesting facts on remittance

- Steps to track international money transfer transactions

- Tracking of an Instarem transfer (remittance transfer provider)

- Tracking wire transfer

- How long does it take to complete SWIFT international wire transfer?

- Can international wire transfers get delayed?

- How to track an international wire transfer?

- How to track international wire transfers with reference numbers?

- How to track wire transfer as a recipient?

- Tracking ACH transfers

- Tracking an international money order

- How to track money order through USPS?

- How to track money order through Western Union?

- How to track money order through MoneyGram?

- Benefits of tracking your money transfer

- Keeping your money close

- Before you go…

Sending and receiving money across international borders has become increasingly common, and as such, you should treat it cautiously to avoid any mismanagement of your outgoing or incoming funds. There are a few reasons to keep track of your money transfer and that include ensuring the funds have been successfully transferred; ensuring there are no discrepancies on the fees and charges; and detecting any potential issues or fraudulent activities.

All these will allow you to take corrective action quickly. Overall, keeping a keen eye on your money transfer status can help you manage your finances more efficiently and ensure that your funds are secure.

Although some money transfers may take up to five days to reach their intended recipient, many money transfer companies and banks provide end-to-end tracking options to monitor the progress of your payment. It’s worth noting that each company has its own unique procedure for tracking transfers.

To gain a better understanding of these differences, let’s take a closer look at how major transfer companies track your money transfer.

Overview of international money transfer

International money transfer is a financial transaction that involves individuals, businesses, or organisations sending money from one country to another. International money transfers can be initiated through various channels, such as banks, remittance transfer providers or digital wallets.

These transfers can be used for a variety of purposes, such as paying for goods and services, supporting family and friends, or investing in foreign countries.

The fees and exchange rates for international money transfers can vary depending on the financial institution or money transfer operator used, as well as the destination country and currency.

Interesting facts on remittance

Remittances sent by migrant workers to low and middle-income countries serve as a critical lifeline to many, and recent data indicates that the amount sent to these nations in 2022 has increased by nearly 5% to $626 billion.

It’s worth noting that not all remittances are transferred from wealthier to less affluent nations.

The World Bank reports that the Russian invasion of Ukraine caused a significant increase in the amount of money sent home by Ukrainians living abroad, resulting in a total worldwide remittance figure of $794 billion.

Steps to track international money transfer transactions

Tracking your international money transfer has become easier than ever, thanks to the digital nature of the transaction. Upon completion of the transfer, most international money transfer providers will furnish you with a receipt, which is typically emailed to you.

The receipt should contain a confirmation number for the transaction, which you should note down for future reference.

With this confirmation number, you can easily contact the remittance service provider to track your international money transfer transaction.

Generally, to track a money transfer, you will need to perform the following steps:

Step 1: Double-check the online payment status, that the transfer has been completed and the funds have been deducted from your account.

Step 2: Review your receipt to locate the payment status, reference number, confirmation number, order number, or a similarly named identifier that can be used to check the transfer.

Step 3: Once you have this information, reach out to the sending company either by phone or online and provide them with the tracking number.

Step 4: In cases where it’s possible, sign up for notifications to receive real-time remittance tracking on each stage of the transfer process, including the expected arrival time and any applicable fees or charges.

Tracking of an Instarem transfer (remittance transfer provider)

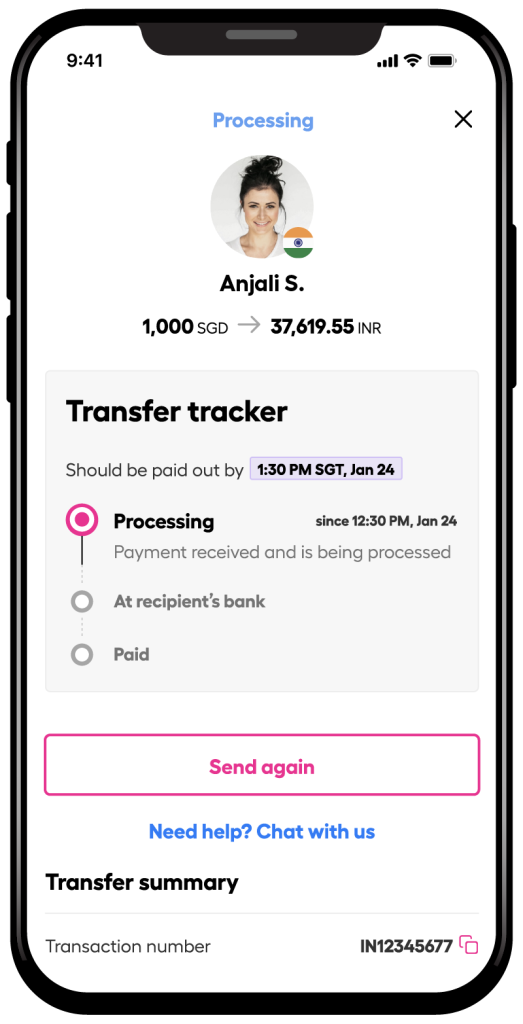

Instarem is a remittance transfer provider, offering low fees & great exchange rates; safe & secure transfer; transparent fee structure; and fast transfer for your international transfers.

Instarem also boasts new technology to ease both sending and tracking where it offers a simple tracking feature — Transaction Timeline feature that allows you to track your transactions in real-time.

You also can turn on the notification alert function, so that you can know when the transaction has been completed.

In addition, with Instarem’s Activity Listing feature, you can keep track of all historical transactions to better manage and plan for your future transactions.

It is worth noting that since Instarem as a remittance service provider supports a myriad of payment options including credit/ debit cards, ACH payments, wire transfers, bank transfers and more, according to the country of origin, Instarem’s technology helps to ease the tracking hassles that you might be facing when sending money through other channels.

Tracking wire transfer

International wire transfers usually take between 1 to 5 business days to complete. If the transfer isn’t delivered within this time frame, it can be traced using a reference number or tracking number or SWIFT codes.

SWIFT stands for Society of Worldwide Interbank Financial Telecommunication and is an international messaging network that banks and financial institutions use to send and receive secure information about money transfers.

A SWIFT transfer involves the sender’s bank processing the money transfer request before sending it to one to three intermediary banks that participate in the transaction before the funds are finally deposited at the recipient’s bank.

The number of intermediate banks that a transfer must go through varies and each bank may impose fees that reduce the final amount received by the recipient.

Today, SWIFT covers 11,000 banks and financial institutions in more than 200+ countries and territories. The electronic transfer of funds from one bank account in one country to a bank account in another country is done through the SWIFT network.

The network itself doesn’t carry out transfers, but it passes along transfer instructions between banks.

How long does it take to complete SWIFT international wire transfer?

Providing an exact timeframe for the average international wire transfer is difficult because multiple factors can influence processing and delivery times. However, in general, it takes about five business days for the money to be accessible in the recipient’s account.

While you can consult with your bank to obtain an approximate duration for an international wire transfer, bear in mind that various factors beyond the bank’s control may affect processing and delivery times. Additionally, these estimates are not necessarily precise and should be considered as such.

Can international wire transfers get delayed?

There are several factors that may affect the time it takes for an international wire transfer to be processed and delivered including various elements such as local bank holidays, cut-off times for transfer requests, anti-fraud regulations, and accuracy of transfer instructions. It is important to be aware of any holidays in the source or destination country when setting up your transfer as this may affect processing times. If transfer instructions are received before the cut-off times, they’ll usually be processed promptly, but if missed, you may have to wait a business day or more.

Also, banks follow Know Your Customer (KYC) rules to prevent fraudulent transfers, which can result in extra checks related to anti-fraud or anti-money laundering regulations. These regulations exist to help keep your money safe.

Additionally, the banking infrastructure in the recipient’s country can also impact the transfer process, as some countries are better prepared to handle international wires than others. Therefore, it is important to ensure that all the information, including the routing number, is correct before submitting a wire transfer request.

How to track an international wire transfer?

When you send money via wire transfer, you will receive a Federal Reference number or fed number as a confirmation of the transaction.

If you have any concerns about the transfer, you can contact the sending bank and request a trace on the transfer using the reference number. Many banks offer this service, although there may be additional fees involved.

It’s important to note that it is not uncommon for recipient banks to hold onto transfers for a day or two before posting the funds in the recipient’s account.

So, if you believe that the transfer should have arrived but it hasn’t, it’s possible that it’s just being processed and you may need to wait a little longer. It’s always a good idea to keep track of your wire transfer reference number and stay in touch with the sending and receiving banks if there are any concerns.

This can help ensure that your transfer is completed smoothly and that your funds are delivered promptly.

How to track international wire transfers with reference numbers?

To track an international wire transfer using your reference number, you need to reach out to the bank or provider who initiated the transfer. This process is called a wire trace, and it allows the bank or provider to use the reference number to locate the transfer’s current location.

Once they have found the transfer, they will provide you with an update on its status, which can help you determine your next steps.

It is important to note that there may be a fee associated with requesting a wire trace, and the time it takes to complete the trace can vary depending on the bank or provider’s policies.

Therefore, it is best to inquire about any potential fees or time frames before requesting a wire trace. In some cases, the transfer may be delayed due to issues with the recipient bank or local regulations, so it is essential to keep this in mind and be patient while waiting for updates.

How to track wire transfer as a recipient?

In case you’re waiting for an international wire payment that has not yet arrived, there are a few steps you can take. Initially, you will need to communicate with the sender to acquire additional information regarding the payment, such as the fed number for the transfer, their bank’s SWIFT code, the expected arrival date, and the payment amount. After obtaining this information, you should inform your own bank to seek advice on whether it’s time to request a wire trace from the sender.

If your bank cannot locate the payment even after providing the extra information, you may have to reach out to the sender and request them to track the international wire from their end via the sending institution.

Tracking ACH transfers

Automated Clearing House (ACH) is a payment system overseen by Nacha in the US. ACH payments include various types of transactions like direct deposits, bill pay, and e-checks, making it a popular choice for paying bills and receiving payments.

ACH payments are processed in batches and are not the quickest means of transferring funds, but they are reliable and cost-effective.

While ACH payments are typically limited to use within the US, international ACH payments are possible. Nacha reported over 100 million international ACH payments worth more than $200 billion in 2021.

However, not all banks offer this service, and you should check with your bank before processing an international ACH transfer. Alternatively, you can use a specialist provider like Instarem, which can convert and send payments overseas through local ACH systems, usually at a lower cost than regular international bank wires.

Although both ACH and wire transfers are methods for moving money between accounts, they differ in terms of speed, cost, and purpose. ACH payments are generally slower but cheaper, making them ideal for domestic transactions like bill payments or payroll.

In contrast, wire transfers are faster since they are processed and sent directly from the sender’s bank to the recipient’s bank. However, they come with significantly higher fees, making them a more expensive option, especially for international transfers.

As a result, wire transfers are often preferred for urgent or high-value transactions, both domestically and internationally.

Can international ACH transfers get delayed?

The ACH Network is the system that enables the secure and reliable movement of money throughout the United States. ACH payments involve multiple entities, including the Originating Depository Financial Institution (ODFI) and the Receiving Depository Financial Institution (RDFI).

Every payment must be approved by the ODFI, go through the Federal Reserve and the Clearing House, and arrive at the RDFI before being deposited into the recipient’s account.

The payment may be rejected and issued a return code, which must be rectified before the payment can be processed.

Due to the involvement of many individuals and entities, processing times for ACH payments can vary, ranging from three to five business days or longer.

How to track an international ACH transfer?

To track the ACH transaction, you need to locate the ACH transaction trace ID number, which consists of two trace IDs for the source and the destination of the transaction. You can find these trace numbers in your online banking or payment account under the transaction details heading.

- If you are the payee waiting to receive a payment, you should contact your own bank with the ACH trace number to track the payment status

- If you are the payer waiting for the transaction to clear, you should contact the payee’s bank. If the transaction’s date and amount are provided, the bank may be able to trace the payment.

Unfortunately, end-users don’t have access to the tracing system, so you must let the bank do the work for you. The bank representatives may request additional information if the payment has been lost in the system, such as the type of transaction.

However, in most cases, they will be able to locate the transfer’s journey and location within the ACH network.

How to locate ACH trace ID numbers?

To locate a payment you have made, log in to your preferred online platform and look for the “Transaction details” section. The location of this section may vary depending on the platform you’re using.

Once you find it, you can access the transaction’s Trace ID, which usually consists of two IDs: the “source” ID and the “destination” ID. The former can be traced the day after the transaction is initiated, while the latter is accessible once the payment has reached the destination bank account.

After you have obtained the Trace ID, you should reply to the intended recipient and provide them with the ID. Encourage them to contact their financial institution to determine the payment’s location and status. This should be sufficient to track down the payment.

Tracking an international money order

Money orders are a type of paper payment that offers a guaranteed payment method, unlike checks. To purchase a money order, you must use cash or another guaranteed form of payment, such as a debit card. Personal checks and credit cards are not accepted.

When buying a money order, you must specify the payee’s name, and the issuing financial institution’s name must be printed on it.

You can purchase money orders from various vendors, such as USPS, MoneyGram, Western Union, select retailers, retail banks, check-cashing stores, and payday loan stores.

Since you prepay for the money order, there is no possibility of it bouncing when it is cashed.

Money orders are beneficial for people who don’t have access to a bank account, are sending money to someone they don’t know well or don’t want to use their personal checks for payment.

The cost of a money order varies depending on the issuer, but it typically ranges from $1 to $5. Money orders are not a preferred payment method for larger amounts due to the limited maximum amount issuers allow.

How to track an international money order?

When you purchase a money order, you will receive a receipt that contains crucial information about the transaction. This receipt serves as proof of purchase and can be used to track the money order in case it gets lost or stolen.

If you realise that you have lost your money order or suspect that it has been stolen, the first step is to track it. To do so, you should contact the issuer of the money order and follow their specific procedures for tracking a lost or stolen money order.

The process for tracking a lost money order can vary depending on the issuer, so it’s essential to follow their guidelines carefully.

How to track money order through USPS?

The United States Postal Service (USPS) has a long-standing tradition of offering money orders, with both domestic and international options available. International money orders can be issued up to $1,500 per single order.

Checking if your money order has been cashed is an easy process that you can do from the comfort of your home by visiting the USPS website. Your money order receipt contains crucial information to track it, including the serial number, post office number, and dollar amount.

By providing these details, you can easily view the status of your money order.

If you need a copy of a cashed money order, you’ll need to fill out PS Form 6401, the official money order inquiry, and submit it to the USPS. It may take up to 60 days for the USPS to investigate the status of a lost or stolen money order.

Unfortunately, you can’t stop payment on a USPS money order, but they can issue a replacement if it’s lost or stolen. However, note that a $9 processing fee applies to replace an international lost or stolen money order.

How to track money order through Western Union?

To track a lost or stolen Western Union money order, there are two options available.

- The first option is to use the request form on the back of the receipt (if available) to initiate the process of tracking or replacing the money order. Once the form is completed, it must be mailed along with a $15 processing fee to the address provided.

- The second option is to complete and submit Western Union’s Money Order Research Request form if the receipt is unavailable. This option requires a $30 processing fee and can take up to eight weeks for Western Union to process requests.

If the money order has already been cashed, Western Union will send a photocopy of the cashed money order. A refund will be issued if Western Union verifies that the money order has not been cashed.

It is important to note that Western Union charges a processing fee of $15 to replace a lost or stolen money order.

How to track money order through MoneyGram?

MoneyGram money orders are a popular and convenient way to make payments. You can purchase them at various retail locations across the United States.

The company also provides the option of purchasing money orders through their website or mobile app. Tracking a MoneyGram money order can be done online by filling out an online form or by calling their customer service number.

In order to track a lost or stolen MoneyGram money order, you will need to provide the serial number and the dollar amount. If you need to request a replacement money order, the same process applies.

Online requests for a replacement money order are typically the fastest and cheapest method. There is a processing fee of $18, and it takes about seven business days or more to process.

If your MoneyGram money order has been cashed, you can request a photocopy of the cashed money order by visiting a participating MoneyGram retail location.

There is a processing fee of $18 for this service, and you will need to complete a MoneyGram Express Payment request.

Benefits of tracking your money transfer

Tracking international money transfers has several benefits, such as it provides peace of mind, as it ensures that your money has been sent and received successfully, and is in the right hands. This can help reduce anxiety and uncertainty, especially when transferring large amounts of money.

Furthermore, tracking your international money transfer allows you to plan your finances better by providing you with a clear timeline of when the money will arrive. This can help you avoid any unnecessary delays or inconveniences and manage your cash flow more efficiently.

Tracking your transfer also helps you detect any potential issues or fraudulent activities, providing an added layer of security.

By monitoring the progress of your transfer, you can take corrective action quickly, safeguard your funds and prevent any financial losses.

Keeping your money close

Tracking your international money transfer is a crucial step in managing your finances effectively. By following the steps, you can ensure that your funds have been sent and received successfully, plan your finances better, and detect any potential issues or fraudulent activities.

Whether you’re sending money to family and friends, sending money for business transactions, or investing in foreign countries, tracking your transfer can provide you with greater transparency, convenience, and security.

The most important tip for tracking your international money transfer is to keep your receipt and reference number safe. This information can be used to track your transfer online, through customer service centres, or when you want to lodge a report at the police station.

Additionally, opting in for notifications can provide real-time updates on the progress of your transfer and ensure that you receive timely information about any changes or updates.

Before you go…

Finally, it’s crucial to choose a trusted online remittance service provider, for example, Instarem or any other money transfer service provider when sending money internationally.

By choosing a trusted provider, you can ensure that your funds are safe and that any issues or concerns can be addressed promptly.

Tracking your international money transfer may seem like a complicated task, but by following the steps we have listed, you can easily do so and ensure that your funds arrive at their intended destination safely and efficiently.

Try Instarem for your next transfer.

Download the app or sign up here.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

![Wise vs Revolut: Which to choose? [2026 Review]](https://qa.instarem.com/wp-content/uploads/2024/03/1572_blog-feature-image-04-768x403.jpg)