Demystifying The Cross-Border Remittances Ecosystem

This article covers:

With a large chunk of the global workforce migrating to foreign countries in search of lucrative career opportunities or better living; the World Bank estimates that migrants will send up to US$636 billion home in 2017, with three-quarters of that being remitted to developing countries.

In 2015, US$440 billion in remittances was sent back to developing countries, but US$32 billion was lost due to high transaction fees incurred during the process, and much more went unaccounted due to informal channels!

Sounds complicated? Fret not! Let us demystify the Cross-Border Payments Ecosystem for you.

The cross-border remittances market is dominated by players like banks and money transfer operators. Traditional ways of transferring money overseas are expensive due to high transfer charges along with hidden fees which are not known to clients. While different in their approaches, the traditional remittance services providers have their own strengths and weaknesses.

Banks

Though banks do not specialise in remittances, they are an essential part of the remittance industry, as they provide the infrastructure that enables money transfers. Major banks are also licensed, trustworthy, and can provide users with other monetary services such as a bank account.

Money Transfer Operators (MTOs)

More specialised than banks, MTOs provide remittance services that are simpler and faster than banks. MTOs typically have the advantage of speaking the local language, and can provide instant cash, unlike banks which can take days to process. (Source: MasterCard Report, 2011).

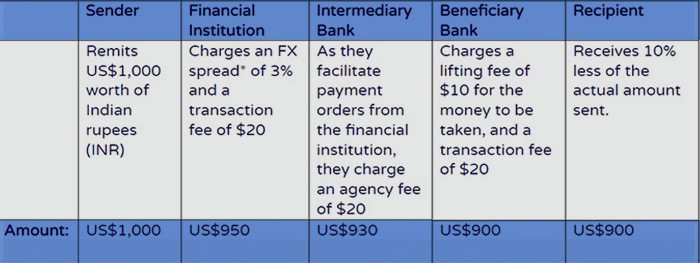

The traditional remittance services providers go through multiple steps to get your money across borders. This process racks up hidden bank and MTO fees for you and your recipient, it’s no surprise that the person you’re sending money to doesn’t get the same amount that you send. Here’s how your money gets “lost” in the process:

*Banks have an internal exchange rate with other banks (the inter-bank exchange rate), but charge customers a higher exchange rate to earn profits from the difference. (Source: Moving with The Money, an InstaReM-Medici Report)

How Cross-Border Payment Methods Are Getting Disrupted

According to the World Bank, sending remittances costs an average of 7.32% of the amount sent. Fintech-based start-ups like InstaReM are disrupting traditional methods of money transfers by removing the FX spread and other hidden fees that are common with traditional remittance players. With its automated platform and strong relationship with banks, InstaReM is able to offer transparent international money transfers at a fraction of a cost, compared to the traditional players. Unlike banks, InstaReM does not require users to physically authenticate their identity, thanks to the implementation of eKYC (Electronic Know Your Customer). This ensures a fast and cost-efficient remitting process. Here’s an infographic that breaks down the process of cross-border remittances for you.

![Wise vs Revolut: Which to choose? [2026 Review]](https://qa.instarem.com/wp-content/uploads/2024/03/1572_blog-feature-image-04-768x403.jpg)