Ensuring Security of Transactions In The Digital Era

This article covers:

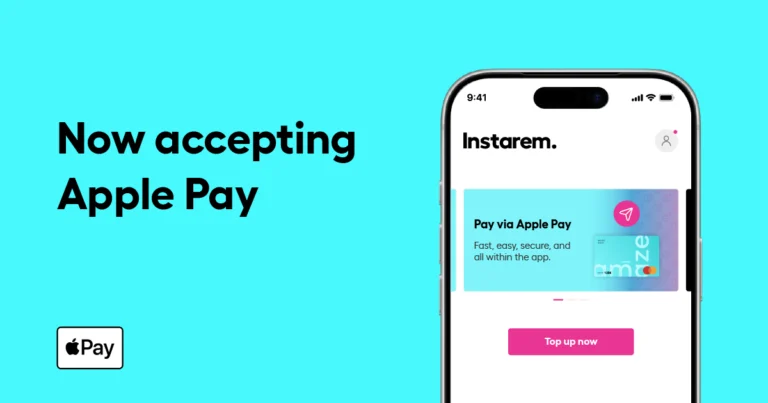

Since the Covid-19 outbreak, the world has witnessed a massive shift in the way people spend money. Digital banking was already gaining ground, but the lockdown has propelled e-payments even further among consumers and business entities. Tech company Grab has reported a 200% increase in the number of GrabPay transactions for GrabFood services in recent months. The rise of digital transactions demands the availability of robust infrastructure supported by vigilant compliance and security features. At InstaReM, our focus has always been on creating an environment that enables you to transfer funds, either domestic or overseas, safely. Our payments platform, powered by our parent entity Nium, complies with the highest standards of security, promising you safe, transparent and hassle-free transactions.

Nium’s operations are bolstered with stringent security measures right from the outset. Our onboarding procedure is streamlined to sift out dubious profiles and validate genuine applicants without compromising on their convenience. Even after the initial Know Your Customer (KYC) process, we continue to screen our database of users periodically to verify the authenticity of individuals on an ongoing basis. Every transaction that enters our system undergoes screenings for Anti-Money Laundering, Combating the Financing of Terrorism etc.

We adopt a comprehensive, risk-based approach to prevent malpractices by:

- Conducting essential checks with regulators’ lists to identify politically exposed persons (PEP), as well as cybercriminals and those barred for fraudulent activities such as money laundering.

- Employing a wide range of tracking tools that monitor suspicious behavior, such as irregular spikes in activity, usage of new email accounts or phone number for signups, unusual cross-border transactions, changing purchase patterns etc.

Given that we are responsible for handling vast amounts of sensitive customer details and information, data protection is of paramount importance to us. Nium’s robust platform enables the consensual sharing of confidential data securely and seamlessly and ensures optimal data life cycle management to prevent its misuse. Our end-to-end data encryption system safely transfers digital information between two parties. The advantage of this is that it protects your data from intermediates such as internet service providers and merchants whose systems it passes through. This ensures that no one, except the sender and the receiver, can interpret or alter your data.

Another advantage of Nium’s infrastructure is that it stores, manages, and processes data using a cloud-based system. Cloud computing offers numerous benefits such as secure storage, interoperability, and 24*7 uptime. With this technology, we can easily scale up and enhance our offerings in case of an influx of transactions.

The growing reliance on digital payments and technology calls for strong mechanisms that are immune to security threats and can handle large volumes of transactions safely. With Nium’s agile solutions, you can be rest assured that your data is secure and your funds reach their destination in the quickest and safest way possible.

![Wise vs Revolut: Which to choose? [2026 Review]](https://qa.instarem.com/wp-content/uploads/2024/03/1572_blog-feature-image-04-768x403.jpg)