This article covers:

- Review your invoicing and payment systems and procedures

- Shop around for competitive credit and financing arrangements

- Make it easy for clients to pay you and buy from you

- Explore the use of multiple currency digital wallets

- Review your inventory

- Review your receivables

- Negotiate early payment discounts

- Offer selective client discounts

- Consider deferral of interest payment

- Look at cash flow extension strategies

- Cut down on what you can cut down

- Understand Days Sales Outstanding (DSO)

If you believe in the saying that ‘cash is king’ then you know how important cash flow is.

Whether you’re providing services or manufacturing products, you need cash to run and grow your business.

The onset of the pandemic and the intermittent lockdowns have highlighted the vital role of cash flow for businesses. Many small and medium businesses struggled to stay open despite government grants.

But with or without the pandemic, having a cash flow management strategy in place is a must for every business. Whether you run a business that relies on international trades and cross-border payments, or an Australian based operation with purely domestic transactions, you need an efficient cash flow system.

When it comes to cash flow management, it is vital that you have a good understanding of your cash flow cycle. This means knowing how many days it takes for you to produce your product or service, sell it, collect and receive payments from customers versus the period of time within which you need to clear payments with suppliers and vendors.

Once you know your cash flow cycle, you can make the necessary adjustments if required.

Here are the top 12 tips to improve your cash flow:

Review your invoicing and payment systems and procedures

The earlier you send an invoice out to customers, the better. This is because with some invoices taking 15-30 days to pay, the earlier you get the payment, the better for your cash flow. Make sure your invoicing and payment system has the ability to send automatic reminders to late payers.

Shop around for competitive credit and financing arrangements

Consider and compare long-term and short-term cash flow extension and review options. For example, even some credit card systems can provide better rates than what some banks can offer. It is a good idea to use a combination of credit and financing providers. Choose those that will fit your business needs.

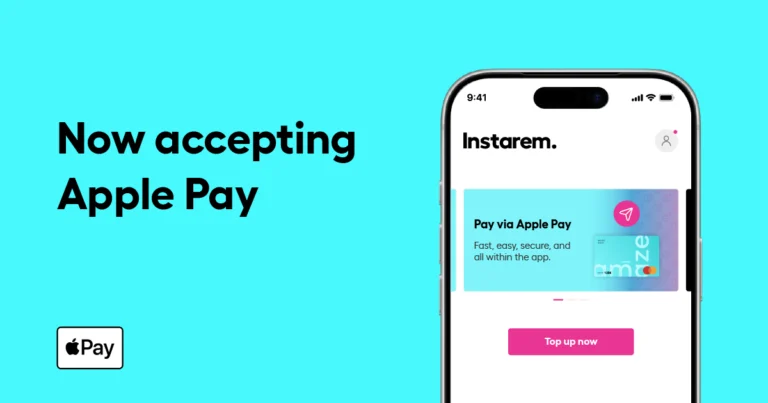

Make it easy for clients to pay you and buy from you

Make sure to offer different payment methods to local and international clients. With digital payments and other online payment apps readily available, accepting cross-border or domestic payments should be a smooth and easy process.

Explore the use of multiple currency digital wallets

With international trade transactions on the rise and more consumers buying online, more companies are gradually using multiple currency wallets to receive receivable funds. With advanced technology that enables seamless financial apps, it is now much easier to open and set-up multi-currency wallets than actual currency bank accounts.

Review your inventory

One of the areas that can easily be neglected or overlooked in some businesses is the high level of inventory. As customer buying patterns and preferences change, it is a good idea to review your inventory system to ensure you have the appropriate inventory level. Not too high nor too low.

Review your receivables

Related to your invoicing and payment system, make sure that you review your receivables on a regular basis. This will help in following up late payers. If you have international clients and are receiving payments in different currencies, Instarem’s multi-currency accounts can help you save on the cost of foreign exchange transactions. With digital invoice and tracking, you can easily monitor money transfers to boost your cash flow.

Negotiate early payment discounts

This is one of the often neglected yet effective ways to manage your cash flow. During the pandemic, it’s normal to be given early payment discounts of anywhere from 0.5-1% or even more if you have very good relationships with your suppliers. After all, they also want their cash early, hence the incentive. If you can negotiate even small discounts on majority of your business purchases, they can all accumulate to substantial savings.

Offer selective client discounts

You can use the discount incentive to encourage your customers to pay early or as soon as possible. While discounting shouldn’t be a business-as-usual strategy, it can be used selectively to boost cash flow at particular business cycles.

Consider deferral of interest payment

If you have business loans that require recurring payments, you may want to talk to your bank or lender and negotiate deferral of interest payments.

Look at cash flow extension strategies

With non-bank financial institutions offering a wide range of financing facilities, it may be worthwhile to consider other cash flow extension products. Credit cards are good products for this when you know how to use them and may be cheaper than bank overdrafts. Knowing your credit card cycle cuts and how you can defer payment to the maximum number of days allowable without paying interest is key. Use credit cards with rewards programs for maximum benefit. Why not explore Instarem Bizpay to help extend cash flow?

Cut down on what you can cut down

When the pandemic hit and many small and medium enterprises were forced into lockdown, business owners had to resort to drastic measures to survive. Some businesses cut back on their product offerings. Others simplified the way they operate. But even without lockdowns, it is best to cut down on any unnecessary expenses to keep your overheads low.

Understand Days Sales Outstanding (DSO)

Reducing DSO is important for your business if you want to increase cash flow. DSO measures the average number of days that it takes a company to collect payment for a sale. A high DSO tells you that a business is possibly selling its products on credit terms and has a longer wait time to collect their money. The lower your DSO the better your business cash flow.

Need a payment solution to improve your cash flow? Sign up for your free Instarem account today.

![Wise vs Revolut: Which to choose? [2026 Review]](https://qa.instarem.com/wp-content/uploads/2024/03/1572_blog-feature-image-04-768x403.jpg)