Instarem Business Card Security: How to prevent fraud & stay protected

This article covers:

- How card fraud works?

- Why small businesses are especially vulnerable?

- Why fraud is a nightmare for small businesses (it’s not just about money)

- Common types of business card fraud

- Spotting the red flags

- Keeping your Instarem Business Card safe: best practices & quick actions

- What to do if your Instarem Business Card is compromised

- Final thoughts

We’re not talking about business name cards here—we’re talking about business bank credit and debit cards that come with a ton of perks. Just like a personal credit or debit card helps you keep your finances in check, a business credit or debit card does the same for your company’s money.

But here’s the thing: business credit and debit cards aren’t just about making transactions easier for you as a business owner. They also let you delegate financial decisions to trusted team members. Sounds great, right? Well, it is—until you have to deal with the downside: business card fraud.

Now, this isn’t your typical “Nigerian prince” email scam. Business card fraud is a whole different beast, and if you’re running a smaller company, the risk-to-reward balance is even more critical since resources aren’t as deep as those of bigger businesses.

Don’t worry—we’ve got you covered. We’ll break down exactly how business card fraud works, how it differs from regular credit card fraud, and most importantly, how you can prevent it. And if you do find yourself caught in a tricky situation? No need to panic—we’ll walk you through what to do next.

How card fraud works?

Ever wonder how credit card fraud detection works? It’s all just a giant game of data crunching. Your spending habits? Just a tiny blip in a sea of millions—sometimes billions—of transactions.

Over time, patterns start to form, and fraud detection systems analyse them, looking for red flags. Sometimes, fraud gets picked up because stolen cards are being tested by bots, sketchy payment terminals are involved, or someone buys something random on Amazon and ships it to a mystery address.

These systems juggle millions of data points, assign risk scores, and flag anything that looks suspicious.

Why small businesses are especially vulnerable?

Unlike your personal credit card, which you probably check religiously, business transactions tend to fly under the radar. Small business owners are busy, and if you’re not combing through statements regularly, fraudulent charges can go unnoticed until—boom—it’s too late.

And since you can’t sit there watching every single transaction like a hawk, you need tools. But those? They cost money. Which brings us to yet another headache.

1. Weak security measures

Some companies go all-in on cybersecurity. Others? Not so much. Weak passwords, no two-factor authentication, outdated payment systems—it’s like rolling out the red carpet for fraudsters.

2. Employee misuse & internal fraud

Handing out company credit cards is convenient,until someone decides to get a little too liberal with their spending. Sure, you have policies, but let’s be honest—you don’t have the time to micromanage every single transaction.

3. Phishing & social engineering attacks

And just when you think internal fraud is your biggest concern—bam! External scammers swoop in. Fake invoices, shady emails, sketchy phone calls—it’s an endless game of “who’s trying to steal from me today?” Click the wrong link, and congrats, you just invited a hacker into your financial system.

4. Not using fraud protection tools

Believe it or not, a lot of small businesses don’t even use the fraud protection features their credit card provider offers. Spending limits? Transaction alerts? Nah, who needs those? (Spoiler: You do.)

The bottom line?

Business card fraud is real, and small businesses are easy targets. Fortunately, a little awareness, the right tools, and a few smart precautions can save you from a major financial nightmare.

Why fraud is a nightmare for small businesses (it’s not just about money)

Fraud can hit small businesses hard, and not just in one way—it can cause all sorts of headaches.

1. Financial losses & extra costs

We know, we know—obviously fraud costs money. But if you think it’s just a few bucks here and there, think again. The financial drain can come from multiple angles:

- Unauthorized Transactions: If fraudulent charges go unnoticed, they can rack up thousands in direct losses.

- Chargebacks & Fees: Sure, you can request a chargeback, but banks often hit businesses with fees, penalties, and lost revenue.

- Cash Flow Disruptions: A drained bank account could mean delays in payroll, supplier payments, or even rent—leading to even more chaos.

- More Oversight = More Expenses: After getting burned once, businesses usually ramp up security, audits, and employee training—all of which cost more money.

2. Damage to your reputation

Fraud doesn’t just mess with your finances—it can seriously hurt your business’s reputation, too. This can eventually impact your customers and suppliers, if fraud related issues delay payments.

3. Time-consuming recovery

And let’s not forget the most frustrating part: the time it takes to fix everything.

After you’re hit by fraud, you’re stuck digging through transactions, filing reports, securing accounts, and figuring out how to prevent it from happening again. It’s not just a financial drain—it’s a time drain. And when you’re running a small business, time is money.

Long story short? Fraud is way more than just an annoying inconvenience—it can shake up your entire business. Prevention is always cheaper (and less stressful) than dealing with the mess after the fact.

Common types of business card fraud

Card-Not-Present (CNP) fraud – online transactions without a physical card

This is when someone uses stolen credit card details to make online purchases—no physical card needed. Cybercriminals only need the card number, expiration date, and security code to pull it off. So, if you’re reading those details out loud while making a payment to an overseas vendor… maybe don’t. You never know who’s listening.

Account Takeover (ATO) fraud – when someone hijacks your business card account

ATO fraud happens when a scammer gains access to your account, changes the login details, and starts spending like they own the place. If this happens, you might have a much bigger problem—like a sneaky trojan virus lurking in your computer system. Yikes.

Employee misuse – unauthorised personal expenses on company cards

Fraud isn’t always an external problem. Sometimes, employees use company credit cards for personal purchases, thinking no one will notice. And when this type of fraud makes the news? It’s messy. Recovering the money, dealing with legal action, and setting up stricter policies take time away from running your business.

Card skimming & cloning – physical theft of card details

This is when criminals install a hidden device on an ATM or payment terminal to steal card data. Once they have it, they clone your card and go on a spending spree. Unlike CNP fraud, skimming requires physical access to your card—or at least the magnetic strip. Just a few seconds, and boom, they’ve got everything they need.

Spotting the red flags

So, how do you know if something shady is going on with your business card? Keep an eye out for these telltale signs:

- Unexpected transactions in places you don’t usually do business

- Small “test” charges before a big, unauthorised purchase

- Unusual spending spikes that don’t match your normal business activity

- Duplicate transactions or payments to vendors you don’t recognise

Now that you know the warning signs, the common types of card fraud, and why small businesses are particularly at risk, let’s talk about what you can do—especially if you’re using an Instarem business card. Because sometimes, bad luck happens, but bad security habits? Those are avoidable.

Keeping your Instarem Business Card safe: best practices & quick actions

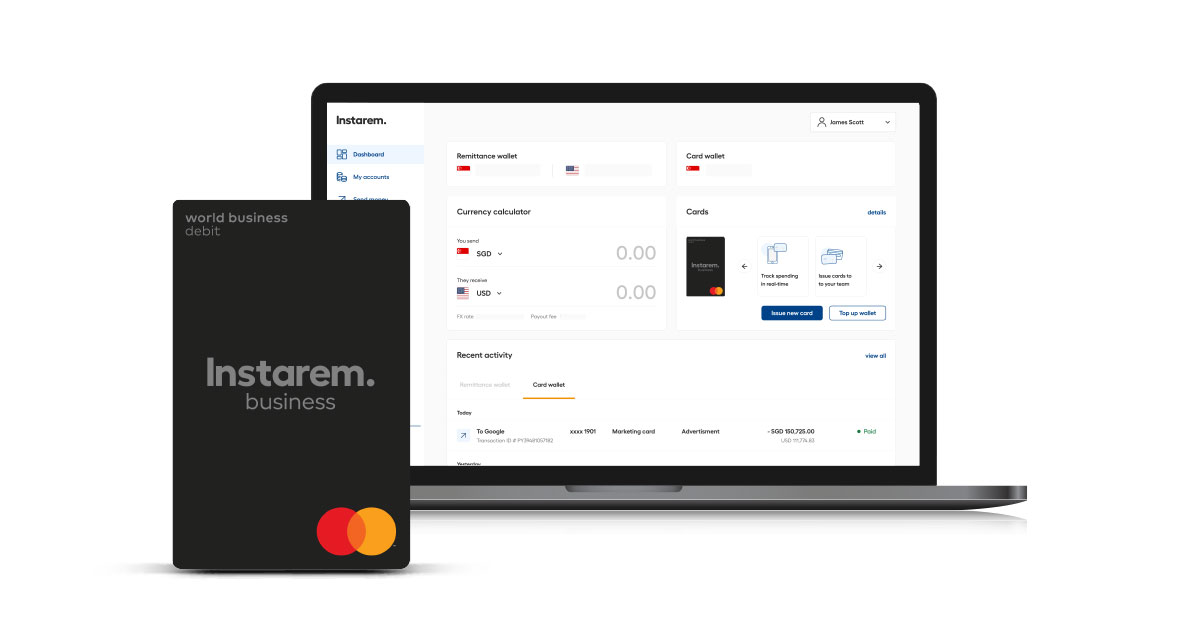

Your Instarem business debit card is a gateway to your company’s finances, so keeping it secure should be a top priority. Here’s how to protect it and what to do if things go south:

1. Protect your card & account info

Good Practice:

- Use strong, unique passwords for your Instarem account—think uppercase, lowercase, numbers, and symbols.

- Never reuse passwords across accounts. If you struggle to remember them, get a password manager.

- Enable two-factor authentication (2FA) for an extra layer of security.

2. Monitor & control card usage

Good Practice:

- Set up spending limits and transaction alerts to keep an eye on real-time activity.

- Regularly review transaction history and flag anything unusual.

- Use MCC restrictions (merchant category codes) and channel limitations to block purchases in high-risk categories.

- For online payments, use virtual cards instead of exposing your primary card details.

On Instarem:

Log into your Instarem dashboard to set limits, customise usage rules, and create virtual cards.

3. Be careful with card information

Good Practice:

- Never share card details when absolutely necessary.

- Always verify the identity of anyone requesting card info—Instarem will never ask for sensitive details through unofficial channels.

- Watch out for phishing scams—double-check emails or messages claiming to be from Instarem.

On Instarem:

If you get a sketchy request, report it to Instarem support immediately.

4. Secure your business systems

Good Practice:

- If an employee leaves the company, revoke their access and block their card.

- Regularly review who has access to your virtual card details.

- Train your team on fraud awareness to prevent internal misuse.

On Instarem:

Use the dashboard to manage user access, block cards, and monitor account activity.

5. Act fast if you suspect fraud

Good Practice:

- Freeze or block the card immediately if you notice unauthorised transactions.

- Regularly review account statements to catch suspicious activity early.

On Instarem:

- Freeze or block the card directly from the dashboard.

- Report fraud by emailing bizsupport@instarem.com within 14 days of the suspicious charge.

6. Keep your devices secure

Good Practice:

- Protect all linked devices with antivirus software and strong passwords.

- Never allow unknown individuals to access your computer remotely.

On Instarem:

- Make sure you only log into your account from trusted devices.

What to do if your Instarem Business Card is compromised

Freeze or Block the Card:

- Go to the card’s page in your Instarem dashboard.

- Click Freeze Card (temporary) or Block Card (permanent, admin access required).

- Confirm and wait for a notification.

Report the Fraud:

- Contact your relationship manager immediately.

- Email bizsupport@instarem.com to dispute the charge within 14 days.

Strengthen Your Security:

- Audit recent transactions.

- Update passwords and security settings to prevent future fraud.

Final thoughts

Fraud prevention isn’t a one-time thing—it’s an ongoing effort. But the good news? By following best practices and using Instarem’s security features—like virtual cards, spending limits, and 2FA—you can significantly reduce your risk.

Stay proactive. Train your employees. Work with trusted vendors. A little effort now can save your business from a major financial headache later.

![Wise vs Revolut: Which to choose? [2026 Review]](https://qa.instarem.com/wp-content/uploads/2024/03/1572_blog-feature-image-04-768x403.jpg)