Debt-free tips: Control debt and your finances like a pro

This article covers:

Ugh, being in debt is just the pits. It feels like no matter how hard you try, you can never escape the weight of those monthly payments hanging over your head. But, if you’re ready to take control of your financial situation and improve your credit score, one way to do it is by becoming debt-free.

Just imagine not having to stress about those bills piling up – and actually saving some of your hard-earned income. Or finally building up that emergency fund or even planning for early retirement!

Trust us, it’s totally achievable once you’re not bogged down by the burden of debt. So, let’s figure out how to become debt-free and start living a more peaceful life.

Create a budget and track your spending

For those striving for debt-free living, the first step is to set a budget and track your spending. It sounds like a lot of work, but it’s worth it in the end. Assessing your income and expenses may feel like a tedious chore, but it’s essential to create a realistic budget that allows you to allocate funds towards debt repayment while also covering your essential expenses.

And don’t forget about tracking your spending habits. It’s not fun to see where all your money goes, but it’s necessary to identify areas where you can cut back and save more. If you’re feeling exhausted just thinking about it, try using budgeting apps or spreadsheets to make it easier.

Boost your income

Keeping up with the rising cost of living is no mean feat – we get it. It’s like a marathon where your pay cheque is lagging, desperately trying to catch up.

And the only probable solution is increasing your income – although it’s easier said than done! So, you’re left with the old side hustle or part-time job routine, or maybe even diving headfirst into the exhilarating world of investing.

It’s a Herculean challenge, no doubt, but hey, it’s the price you pay (literally) to live a life without the constant nagging worry of bills and debts.

Refinance your loans

Who wouldn’t want to delve into the fascinating realm of refinancing? It’s like magic, where you trade in your old loan for a shiny new one with better terms. No need for wands and spells here, just a practical approach to improving your financial situation.

With lower interest rates, your debt becomes as light as a feather, propelling you towards debt freedom faster than a flying wizard!

Consolidation is the key to escaping the chaotic juggling act of multiple payments. Say farewell to that madness and embrace the simplicity of a single monthly payment. As for those unpredictable twists of interest rates, fear not! Refinancing transforms those pesky variable-rate loans into dependable fixed-rate loans.

Of course, before you embark on your refinancing adventure, you might want to seek the counsel of a financial advisor or loan specialist. Which brings us to our next tip…

Seek professional advice

Yup, that’s right, it’s time to call in the big guns – a financial advisor or credit counselling service. They’ll offer personalised guidance, a debt repayment plan, and valuable financial insight on how to become debt-free (and stay that way).

Oh, and don’t forget to put a leash on your credit card – avoid unnecessary spending and keep an eye on your finances. Better yet, consider a debt consolidation plan and negotiate with your creditors.

Trust us, being debt-free is way better than drowning in the burden of debt.

Choose snowball or avalanche

Listen up folks, we’re not here to tell you to go out and pick up a winter sport – as fun as that may be. Instead, we’re here to talk about everyone’s favourite topic – how to become debt-free. Let’s cut to the chase, shall we?

There are two popular debt repayment strategies: the snowball and the avalanche method. With the snowball method, you start by paying off your smallest debts first, gaining motivation and momentum as you move up to larger debts.

And with the avalanche method, you focus on paying off the debts with the highest interest rates first to save yourself some money in the long run.

Let’s understand the two repayment approaches using the following debt examples:

- Credit Card A: $1,000 balance with a minimum payment of $50 and an interest rate of 18%.

- Personal Loan B: $5,000 balance with a minimum payment of $100 and an interest rate of 10%.

- Car Loan C: $10,000 balance with a minimum payment of $200 and an interest rate of 6%.

Snow ball method

Using the debt snowball method, you prioritise debts based on their balance, regardless of the interest rate. Here’s how it works:

- Step 1: Focus on Credit Card A

You make the minimum payments on Personal Loan B and Car Loan C, but you allocate any extra funds you have towards Credit Card A. Let’s say you manage to pay an additional $200 per month towards it, making the total payment $250. After a few months, you completely pay off Credit Card A. The sense of accomplishment and progress motivates you to keep going. - Step 2: Move to Personal Loan B

Now that Credit Card A is paid off, you take the $250 you were putting towards it and add it to the minimum payment of $100 for Personal Loan B. Your new payment becomes $350.

With this accelerated payment, you make steady progress on Personal Loan B. After some time, you successfully eliminate it as well. - Step 3: Tackle Car Loan C

You continue the momentum by rolling over the previous payments. With the $350 from the paid-off Personal Loan B, plus the minimum payment of $200, your new payment for Car Loan C becomes $550.

With this higher payment, you make substantial progress on Car Loan C. Eventually, you conquer the last remaining debt.

By following the debt snowball method, you started with the smallest debt (Credit Card A) and worked your way up. The small victories of paying off each debt boosted your motivation and created a snowball effect.

Avalanche method

With the avalanche method, you prioritise debts based on their interest rates, regardless of the balance. Here’s how it plays out:

- Step 1: Focus on Credit Card A:

You make the minimum payments on Personal Loan B and Car Loan C, but you allocate any extra funds towards Credit Card A. Let’s say you manage to pay an additional $200 per month towards it, making the total payment $250.

After a while, you successfully eliminate Credit Card A, as it had the highest interest rate of 18%. You’ve taken down the most costly debt first. - Step 2: Move to Personal Loan B

Now that Credit Card A is paid off, you redirect the $250 you were putting towards it, along with the minimum payment of $100 for Personal Loan B. Your new payment becomes $350.

With this increased payment, you make solid progress on Personal Loan B. Over time, you pay off the loan, leaving you with only Car Loan C. - Step 3: Tackle Car Loan C

Finally, with Credit Card A and Personal Loan B out of the picture, you focus all your financial firepower on Car Loan C. You continue making the $350 monthly payment, which is now dedicated solely to Car Loan C.

With this aggressive payment, you steadily chip away at the principal balance of Car Loan C. Eventually, you triumphantly pay off the last remaining debt.

By employing the avalanche method, you prioritised debts based on their interest rates. This strategy allowed you to save money on interest payments in the long run.

While it may have taken longer to pay off Credit Card A compared to the snowball method, you ultimately reduced the overall interest paid and successfully eliminated all your debts.

So go ahead and pick the method that works best for you, because let’s be real, nothing beats the feeling of being debt-free.

It’s not rocket science, really…

You can embark on the thrilling journey of debt-free living starting today! It’s all about making sacrifices, getting your hands dirty, and mastering the art of rejecting those tempting luxuries. Who needs a fancy car anyway?

Embrace the joy of sardine-like commutes on public transit every morning. And cooking your own meals? It’s like a culinary adventure your mom will be proud of.

But let’s not forget, this is your chance to acquire new skills like financial planning and the art of wallet-wrestling.

Most importantly, when you reach the end of this uphill climb, your question will shift from “How do I become debt-free?” to the more promising “How do I grow my money?”.

Before you go…

Looking to become debt-free as an expat can feel like navigating through uncharted waters. You’re already in a foreign land, trying to manoeuvre a new culture and language, and now you’re adding financial planning on top of all that?

That being said, you need to take your first step towards debt-free nirvana.

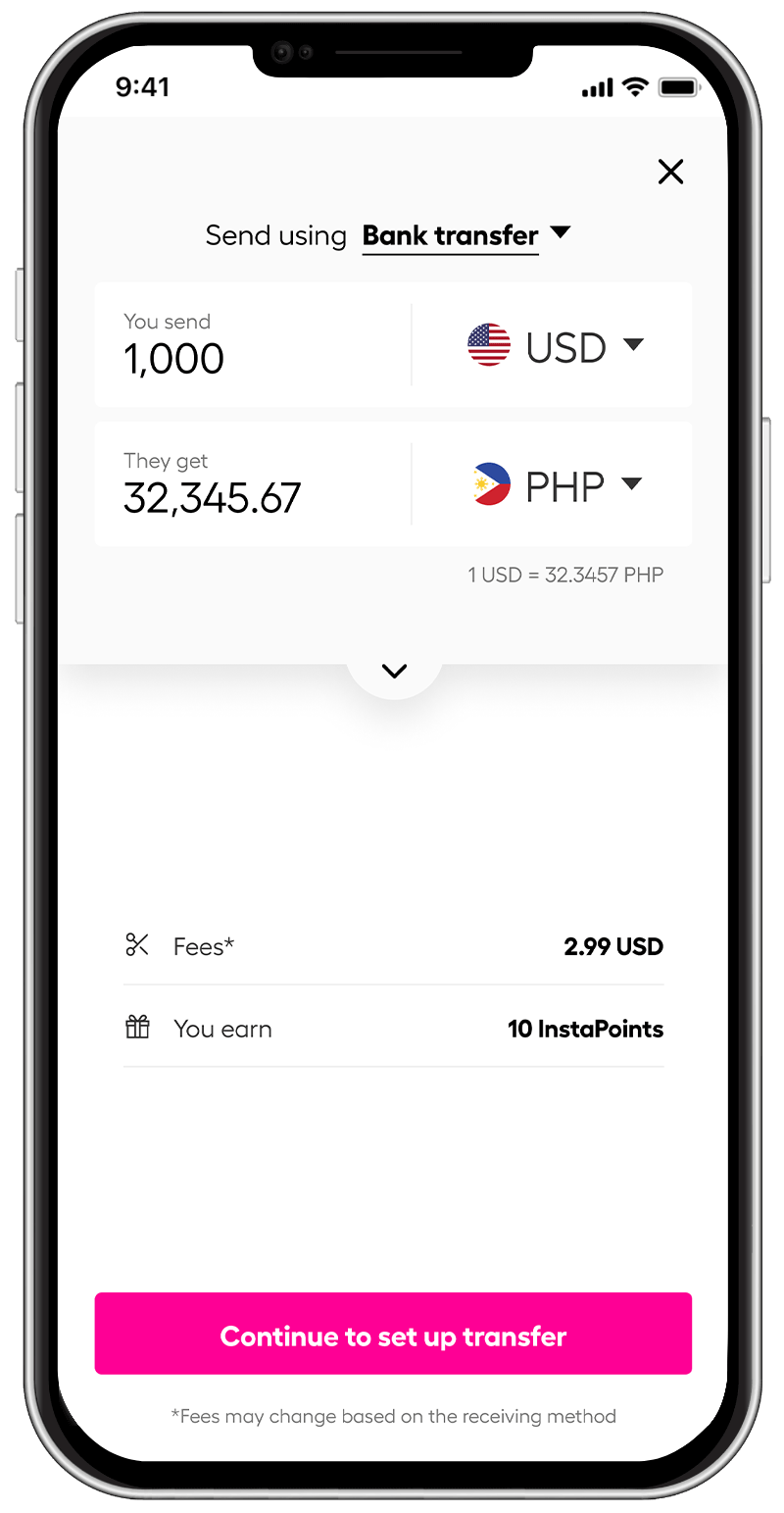

If you want to avoid breaking the bank on cross-border transactions while sending money abroad, give Instarem a go. Just because you’re trying to save money doesn’t mean you have to sacrifice convenience and ease of money transfer.

*rates are for illustration purposes only.

Plus, with Instarem’s great rates and low fees, you’re sure to save a few extra bucks!

Try Instarem for your next transfer by downloading the app or sign up here.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.